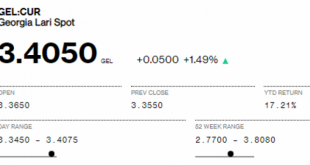

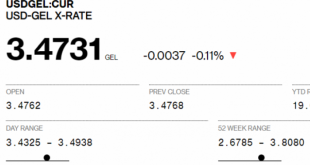

TBILISI(BPI)- The recent depreciation of the GEL’s exchange rate is linked to uncertainty caused by the coronavirus outbreak that has been transmitted to the financial markets through the channel of expectation, the National Bank of Georgia (NBG) said in a statement issued today.

The NBG explains reasons for the depreciation of the GEL and notes that the NBG is ready for any developments.

“The uncertainty regarding the coronavirus pandemic has increased significantly in recent days both at the international and regional levels. This uncertainty is transmitted through the channel of expectations to the financial markets, including the exchange rate, which is the result of the recent depreciation of the GEL after one month of the rate strengthening.

The depreciation was caused by several factors. On the one hand, the spread of coronavirus globally and in Georgia triggers the expected decline in tourist flows. At the same time, the decline in international oil prices indicates the decline of foreign demand from Georgia’s trading partners by oil export and possible decrease in money transfers. As a result, the risks of reducing foreign exchange inflows have increased, which has been reflected in the foreign exchange market through the channel of expectations. There is the same situation in the most countries in our region, where local currencies have declined in recent days. On the other hand, due to the restriction of air travel, the outflow of currency from Georgia to foreign countries will be reduced, as well as the import of tourism services will be reduced, which will have a positive effect on the exchange rate. At the same time, Georgia’s reliance on remittances from oil-exporter countries has been significantly reduced, which is also a positive factor.

The main task of the National Bank is to maintain price stability in the country, i.e to keep the low rate of the inflation. Although the weakening of the external demand reduces the inflation, exchange rate depreciation has the opposite effect and increases inflationary risks. The ultimate impact on inflation, and thus the response of the National Bank, will depend on which factor outweighs the others. At this stage, uncertainty about possible developments is high, but the NBG is ready for any developments. We monitor market dynamics on a daily basis and, as usual, we will use all the tools at our disposal to ensure the core mandate of the National Bank, price stability, “the NBG said in a statement.

commersant.ge

Business Political Insights BPI.GE

Business Political Insights BPI.GE